Cash-strapped homeowners see “We Buy Houses” signs as a fast escape route. These companies promise quick sales without the hassle of repairs or waiting for buyers.

Sellers facing foreclosure or needing immediate relocation find these offers tempting. The promise of cash in hand within days attracts desperate homeowners.

“We Buy Houses” companies aren’t a ripoff, but they typically pay 20-30% below market value. The reduced price represents your payment for speed, home conditions and convenience.

In this blog post I will guide whether the “We Buy Houses” companies are a ripoff and how these companies work, when to use them, and how to protect yourself from predators.

Key Takeaways

- “We Buy Houses” companies typically offer 70-85% of market value, meaning homeowners lose $10,000-$50,000 compared to traditional sales.

- Some companies are legitimate businesses while others are scams; verify credentials through BBB profiles, licenses, and local references.

- Hidden fees like transaction costs may exist despite “no fees” advertising, reducing your final proceeds at closing.

- These companies provide legitimate value for sellers needing quick cash within 7-14 days without repairs or contingencies.

- Getting multiple offers and comparing to traditional realtor pricing helps determine if the convenience justifies the lower price.

What Does “We Buy Houses” Really Mean?

“We Buy Houses” refers to companies that buy homes directly with cash. They don’t list homes for sale. Instead, they purchase properties straight from homeowners without using real estate agents.

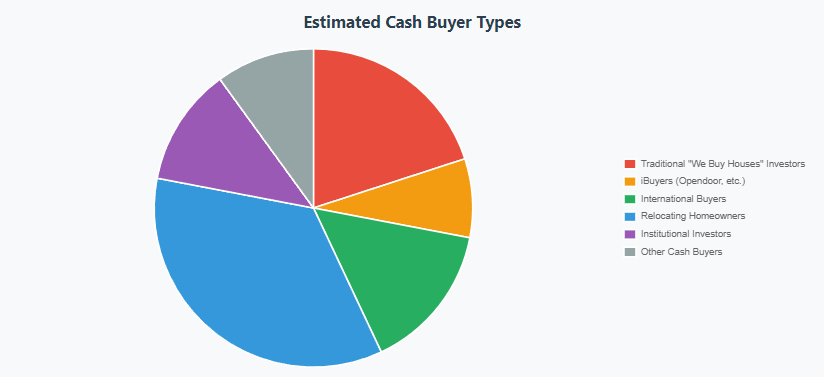

These buyers focus on homeowners who need to sell quickly. They purchase homes in their current condition. You won’t need to make repairs or clean before selling. The buyers include house flippers, online companies like Opendoor, and landlords.

The selling process moves much faster with these companies. You can close the deal within days or weeks. No home staging or showings are required. You also won’t wait for bank approvals.

The main drawback is receiving less money for your home. These companies pay below market value on purpose. They make their profit by buying cheap, fixing problems, and reselling.

Homeowners trade maximum profit for speed and convenience.

Are “We Buy Houses” Companies Legit or a Scam?

Some “We Buy Houses” companies are legit, while others are scams. Real companies buy homes legally for cash every day. But fake buyers also exist in this market. You should check carefully before working with any company.

These cash buyers don’t need licenses in most states. This makes it easier for scammers to operate. Good companies and bad ones work in the same field. The lack of rules creates risks for home sellers.

You must verify any company before trusting them. Look up their business registration first. Check if they’ve a real office address. Read reviews from other sellers online.

Don’t rush when someone offers to buy your house quickly.

Remember that legitimate buyers will answer your questions clearly. They should show you proof of their past purchases. They won’t pressure you to sign papers immediately.

Take your time to make sure you’re dealing with honest people.

How Do Cash Home Buyers Make Money?

You might wonder how these companies profit from buying your house at below-market prices.

They’ll typically purchase your home for 70-85% of its value, invest in strategic repairs and upgrades at wholesale costs, then flip it for a substantial profit or rent it out for steady income.

This business model works because they’re taking on the risk, time, and capital investment that you’re avoiding by selling quickly for cash.

Buy Houses

Companies that buy houses offer quick cash for homes. They target homeowners who need to sell fast. These companies pay less than market value. Their offers usually range from 70-85% of what your home is worth.

House-buying investors look for homes that need repairs. They also seek sellers in tough situations. After buying your home, they fix it up cheaply. They’ve connections with contractors who charge them wholesale prices.

You would pay much more for the same repairs. The investors know exactly what to fix. They spend money only on changes that increase value. Then they sell the fixed house for much more money.

Their profit comes from this price difference. Some investors flip houses for quick cash. Others rent properties for long-term income. Either way, they make money from paying you less than market value.

Repair Them

Investors start fixing homes right after buying them at discounted prices. They already know what needs repair before making their offer. Their repair costs are much lower because they work with contractors who give them special deals.

They spend $20,000-40,000 on repairs that would cost you $50,000-70,000.

Experience gives investors an edge when fixing homes. They know which repairs will make the most money back. They don’t waste money on things that won’t increase value. They focus only on what buyers want, not personal preferences.

Most investors replace old roofs and update kitchens and bathrooms. They also put on fresh paint and install new floors.

Within 3-6 months, the once-rundown house looks completely different. The fixed-up home is now worth much more than what they paid for it.

Flip or rent

Investors must decide whether to flip the house or rent it out. Flipping means selling quickly for a profit after making repairs. Renting means keeping the property and collecting monthly payments.

A house flip can make 20-30% profit within a few months. Investors will list your former home at market value after fixing it up. You might see it advertised for much more than they paid you. This price difference can be upsetting.

Rental investors become landlords instead of selling right away. They collect monthly rent that pays their mortgage plus extra money. They hope the property value increases over time. This approach gives them steady income for many years.

Investors calculate their profits before making you an offer. They factor in all repair costs and other expenses. They also include their desired profit margin from the beginning.

Do “We Buy Houses” Companies Pay Fair Prices?

“We Buy Houses” companies don’t pay full market value for homes. They usually offer between 70-85% of what your house is worth. Sometimes they offer as low as 30% for homes needing lots of repairs. This lower price isn’t the same as a fair market price.

These companies pay less because they take on risks. They must fix any problems with the house. They use their own money to buy your home right away. The discount represents what you pay for a quick, certain sale.

You face a clear choice when selling your home. You could wait months for a full-price offer on the open market. Or you could take less money and close in just a few weeks. The price reflects this convenience.

Your situation determines whether this trade-off makes sense for you. If you need to sell quickly, the lower price might be worth it. If you can wait for maximum profit, a traditional sale might work better. The “fairness” depends on what matters most to you.

What’s the Catch With Selling to Cash Home Buyers?

You’re probably wondering what the real trade-offs are when selling to these cash buyers.

While they’ll close quickly and buy your home as-is without repairs or agent commissions, you’ll sacrifice a significant chunk of your home’s value and face limited negotiation power.

Let’s examine both the advantages that attract sellers and the drawbacks that make others hesitate.

Pros

- Fast sales: Cash buyers close deals in days instead of months.

- As-is purchases: No need for repairs or upgrades; they take the home in its current condition.

- No agent fees: You save the typical 5–6% commission, keeping more money in your pocket.

- Guaranteed sale: No mortgage approvals or loan issues can derail the deal.

- Peace of mind: Certainty of closing helps in urgent or stressful situations.

- Simplified process: Less paperwork compared to traditional sales.

- No showings required: You avoid strangers walking through your home.

- No repair requests: Buyers don’t demand fixes after inspections.

Cons

- Cash home buyers usually pay less than traditional buyers.

- Most cash offers are 20–30% below market value, which can mean losing thousands.

- Deals are often presented as “take it or leave it” offers with little room to negotiate.

- Without competing buyers, you can’t be sure you’re getting a fair deal.

- Sellers have limited bargaining power in cash transactions.

- The industry is largely unregulated, with many companies operating without licenses or oversight.

- This lack of regulation creates opportunities for scammers to exploit sellers.

How Do I Avoid Being Ripped Off by a Cash Home Buyer?

You can protect yourself from cash home buyer scams by taking essential verification steps before signing anything.

Verify Business

Legitimate cash home buyers have clear business records you can check. You should verify three main things before working with them. Good companies leave proof of their work that you can find easily.

First, make sure they’ve a real office you could visit. Check if their website looks professional with working phone numbers. Companies with only P.O. boxes might be hiding something important from you.

Next, check if they’re registered with your state’s government. You can look this up online through the Secretary of State website. Some states require special licenses for home buyers. Ask for their license number if your state needs one.

Last, look up what other people say about them online. Check the Better Business Bureau, Google reviews, and Trustpilot ratings. Be careful if they’ve no reviews or only brand new ones. Unresolved complaints are a big warning sign too.

Never work with buyers who can’t show you basic business information. Real companies are happy to prove they’re legitimate. Your home is too valuable to risk selling to someone untrustworthy.

Check License

Cash home buyers don’t need licenses in most states. However, some states do require specific permits or registrations. You should check your local laws about this.

Different areas have different rules for property buyers.

You can find out about license needs by calling your state’s real estate office. Ask your buyer if they’ve a license number you can verify.

Don’t just believe what they tell you without checking it yourself.

Good companies will happily show you their credentials when asked. They won’t get upset or try to change the subject.

If a buyer seems nervous about sharing license details, be careful. This could be a warning sign.

Check the Reviews

Online reviews show how cash home buyers really do business with sellers. You can see if they keep their promises about prices. Reviews tell you if they talk clearly and finish deals on time. Don’t just trust the good stories on their website.

Look at other places for honest reviews. Google Reviews shows what many customers think. The Better Business Bureau gives ratings based on customer complaints. Trustpilot and Yelp have stories from people who sold homes in your area.

Watch out for bad signs in reviews. Multiple people might mention hidden costs or last-minute price cuts. Some companies use pressure to make you sell quickly. If you find no reviews, this could be a problem.

Good companies will have both good and bad reviews. They should respond well to problems. If all reviews look perfect, be careful. Real businesses aren’t perfect but they fix their mistakes.

Check BBB Profile

The BBB helps you know if a cash home buyer is trustworthy. They keep track of customer complaints and how businesses solve problems. You can see if a company treats customers fairly before you work with them.

The BBB gives companies ratings from A+ to F. A high rating means the company follows good business practices. You can find customer reviews and see any problems that weren’t fixed. This information tells you who to avoid.

Go to BBB.org and type in the company’s name. Check if they’re really BBB accredited. Look for patterns in customer complaints about the company. Multiple problems with low offers or hidden fees are warning signs.

Good companies respond to complaints quickly and fix problems. Bad companies ignore customer concerns or make excuses. A cash buyer with a clean BBB record will likely treat you fairly.

Get Local References

Local references show if a cash buyer has helped other homeowners in your area. They prove the buyer has done real deals near you. You can trust them more if they’ve good references.

Ask for 3-5 recent sellers who sold homes like yours in the last six months. Call these people yourself and ask about their experience with the buyer. Find out if they got the price they were promised.

You should drive by these properties if you can. This helps you check if the buyer really bought and fixed them. Local references are a good way to spot honest buyers.

Beware of buyers who won’t give references because of “client privacy.” Good buyers keep in touch with past sellers. These sellers are often happy to talk about their experience.

No references means you should look for another buyer.

Compare Offers

You should get multiple cash offers to avoid accepting a low price. This helps you spot bad deals quickly. Comparing three to five offers side-by-side shows you the fair market value.

Request offers from different buyer types. Local investors know your neighborhood well. National companies have set processes. iBuyers use technology to make quick offers. Each may value your home differently.

Tell buyers you’re getting multiple offers. This creates healthy competition among them. They’ll likely give their best price right away. You’ll have more power in the negotiation.

Look at more than just the offer amount. Check the closing timeline in each offer. Review any fees they might charge you. Consider what contingencies they include. These details matter just as much as price.

If all offers seem too low, consider other selling options. You might get more money through a traditional sale. A real estate agent could help you explore alternatives.

Get Written Contracts

Written contracts are essential when selling your home for cash. They protect you and make the sale legal. Verbal deals don’t hold up in court. A proper contract spells out all the details about your sale.

Your contract must list the exact price you’ll get. It should show when you’ll receive your money. The document needs to include any fees you must pay. You should see all closing costs clearly written down.

The contract should mention conditions that could cancel the sale. It must have clear deadlines for closing the deal. All important dates should appear in the document. You shouldn’t sign anything you don’t fully understand.

Ask a lawyer to check your contract before signing. A good buyer won’t rush you to sign papers. They’ll expect you to read everything carefully. If someone refuses to put terms in writing, find another buyer.

10 Questions to Ask “We Buy Houses” Companies to Avoid Scams

Asking smart questions can protect you from “We Buy Houses” scams. Always request proof of funds first. Legitimate buyers can show they’ve money ready. Here are 10 smart questions to ask “We Buy Houses” companies to avoid scams:

- Are you a local company or a national franchise?

(Local companies are often more accountable and familiar with the market.) - Can you provide proof of funds for the purchase?(Legitimate buyers should show a bank statement or lender letter.)

- How quickly can you close, and who chooses the title company? (A red flag if they refuse to use a reputable, neutral title/escrow company.)

- Will you be the actual buyer, or are you wholesaling my contract? (Some “buyers” just flip contracts and never intend to purchase your home.)

- Are there any fees, commissions, or hidden costs? (Cash buyers should not charge commissions like realtors.)

- Can you provide references or reviews from past sellers? (Real sellers’ testimonials add credibility.)

- How do you determine your cash offer amount? (Scammers avoid transparency in pricing.)

- Do you purchase houses as-is, including repairs and cleanup? (A legitimate cash buyer won’t ask you to fix things before closing.)

- What happens if I change my mind before closing? (A fair company won’t pressure you with penalties.)

- Will I get everything in writing before I sign anything?(Never rely on verbal promises—scammers often avoid paperwork.)

Do They Really Buy Houses in Any Condition?

Yes, most cash home buyers will purchase houses no matter how bad they look. They want properties they can fix up and sell for more money. These investors see value where others see problems. They’ve the skills to turn ugly houses into nice ones.

Cash buyers accept homes with serious problems like broken foundations or leaky roofs. They don’t mind outdated kitchens or old electrical systems. Many will even buy houses with fire damage or ones filled with junk. Their business model depends on buying cheap, damaged homes.

Some companies have stricter rules. iBuyers like Opendoor usually want newer, nicer homes. They look for houses built after 1960 that don’t need much work. These companies offer a different service than traditional cash buyers.

Traditional “We Buy Houses” investors truly mean what they advertise. They’ve teams of workers ready to tackle big problems. These buyers can handle repairs that would scare away regular homebuyers. You won’t need to fix anything before selling to them.

Will I Lose Money If I Sell to a Cash Home Buyer?

Yes, you may get less money when selling to a cash home buyer. But the lower price comes with some benefits. You won’t pay real estate agent fees of 5-6%. You’ll avoid closing costs that normal sellers pay. The sale happens much faster than traditional home sales.

Your situation matters when deciding if cash sales make sense. Homeowners facing foreclosure might benefit despite lower offers. People with houses needing expensive repairs often choose cash buyers. Those who inherited unwanted property may prefer quick cash sales.

Speed and certainty are the main advantages of cash buyers. You can often close the deal within days or weeks. You won’t deal with buyers who can’t get approved for loans. The process is simpler with much less paperwork.

How Fast “We Buy Houses” Companies Close on a House?

These companies can close on your house in 7-14 days. Some buyers might even finish in 2-3 days if paperwork is ready.

This timeline is much faster than regular sales. Traditional home sales typically take 30-60 days to complete.

Speed comes from working with cash buyers. They don’t need mortgage approvals or lengthy bank processes. Their money is already available for immediate purchase.

You won’t face delays from financing issues. This quick closing helps people in urgent situations.

You might need to sell quickly due to foreclosure or a job move. You could be settling a family estate that needs immediate attention.

The guaranteed fast sale often makes up for the lower offer price.

Is Selling to “We Buy Houses” Better Than Listing With a Realtor?

Neither option is better overall. Your personal needs will determine the best choice for you.

Cash buyers provide quick sales when you need fast money. They can close deals within two weeks without repairs. You don’t need to stage your home or host open houses. This works well for people facing foreclosure or sudden job changes.

Realtors help you get more money for your house. They create competition among buyers to raise your price. Your home will stay on the market longer with a realtor. This option takes 1-2 months to complete the sale process.

Cash buyers typically pay less than market value for homes. You might get only 70-85% of what your house is worth. Realtors work to get you the full value of your property. They know how to market homes effectively to interested buyers.

Choose cash buyers when speed matters more than profit. Pick realtors when you can wait for maximum money.

Consider your timeline, financial needs, and property condition before deciding.

Overview of “We Buy Houses” in Florida: A Fast Option with Trade-Offs

Conclusion

“We Buy Houses” companies offer a legitimate service in the real estate market. They provide quick sales for homeowners who need immediate solutions. If you’re facing foreclosure or can’t afford repairs, these companies can be helpful. However, you should understand that convenience comes at a cost.

Companies that buy houses for cash typically offer below market value for properties. This trade-off allows sellers to avoid real estate commissions and closing costs. If you need to sell quickly due to relocation or financial hardship, a cash offer might make sense. When time matters more than maximum profit, these services become valuable options.

At Greg Buys Houses, we buy houses for cash in Pensacola FL, while striving to make fair offers. We handle all repairs and paperwork to simplify your selling experience. If you’re considering a quick sale, we can provide a no-obligation cash offer within 24 hours. Contact us today to discover how we can help solve your property challenges.